- Facebook stock dropped an astounding 24% after it declared its second quarter monetary outcomes on Wednesday.

- The dive came after Facebook administrators reported that the organization expects a noteworthy stoppage in its income development in the years ahead.

- This is what occurred amid the unfortunate telephone call with investigators that saw Facebook esteem fall by as much as $148 billion.

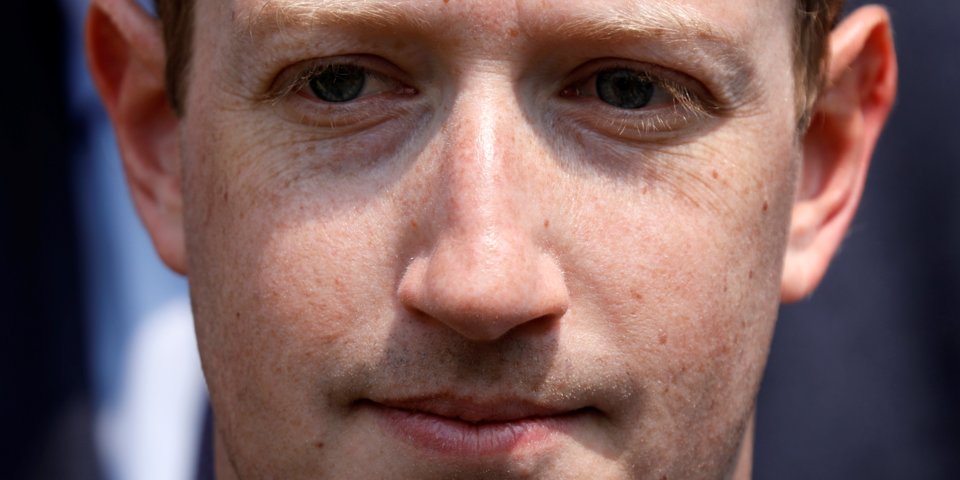

Facebook CEO Mark Zuckerberg reported another vibe great measurement on a telephone call with money related investigators on Wednesday: Some 2.5 billion individuals 33% of the total populace now use no less than one of Facebook’s items every month.

Yet, that amazing measurement wasn’t sufficient to occupy financial specialists from the awful news the organization needed to share it expects essentially diminished income development rates and working edges in the years ahead.

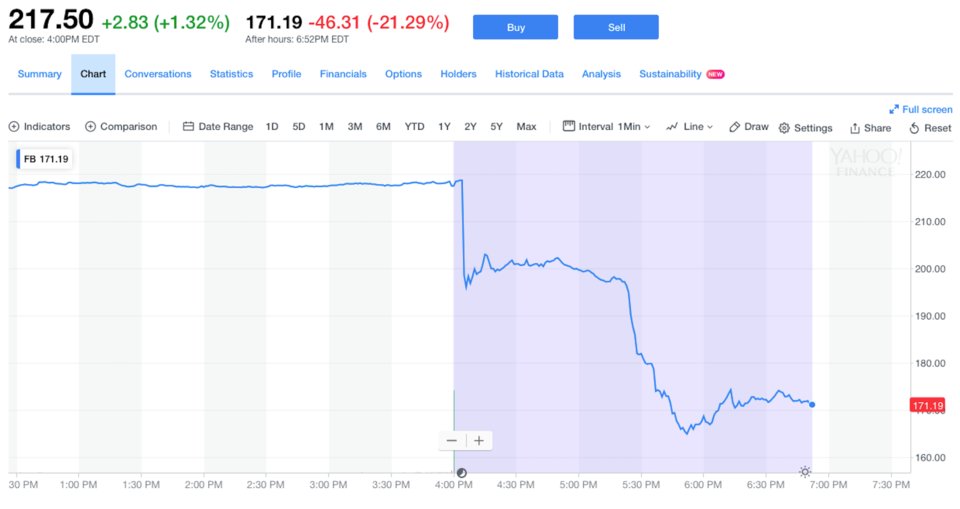

The confirmation was in Facebook’s stock, which amid the call was down as much 24% from its cost at the end of normal exchanging. Truth be told, the call with Zuckerberg and his associates just compounded the situation for Facebook, regarding its offer cost.

A hour prior to the call began, Facebook reported baffling second quarter budgetary outcomes . The organization missed Wall Street’s desires on the two incomes and its number of day by day and month to month dynamic clients.

Its stock fell over 8% on that news. In any case, it remained generally relentless from that point onward, in any event until the point when the call began and David Wehner, Facebook’s CFO, begun talking about the organization’s money related standpoint. Wehner cautioned that Facebook anticipated that its income development would moderate from the 42% pace it posted in the second quarter and its working edges to tumble from 44% in the period.

“Looking past 2018, we foresee that aggregate cost development will surpass income development in 2019,”

he said.

“Throughout the following quite a long while, we would envision that our working edges will drift towards the mid-thirties on a rate premise.”

Facebook’s stock extremely tumbled off amid the organization’s profit call

Amid the call, Facebook’s stock dropped abruptly. Inside minutes it was down 15%, at that point 18%, at that point over 24%. At the stock’s most reduced point, more than $148 billion of the organization’s esteem essentially more than the whole market top of IBM ($134 billion) had been wiped out.

Facebook’s offers bounced back later, however at the season of this written work, despite everything they stayed somewhere down in the red, at somewhat more than 20% down.

Three key variables are driving Facebook’s normal income development decay, Wehner said. To start with, Facebook is engaging cash headwinds. Its abroad income got a lift in dollar terms as the dollar acknowledged against different monetary standards a year ago. Be that as it may, the dollar’s decrease this year will diminish the dollar estimation of Facebook’s outside income.

Second, the organization is putting more accentuation on Stories, the bundles of posts and photographs clients can impart to their companions that by and large vanish following 24 hours. The organization doesn’t yet profit from Stories as from its news channel and different highlights on its site.

And after that there’s an expanded spotlight on protection and security, which Zuckerberg had beforehand cautioned could hurt the organization’s productivity. New alternatives that Facebook is putting forth clients to quit certain information accumulation roused to some degree by another security law in Europe could prompt less publicizing income.

Facebook’s normal decrease “is past anything we’ve seen”

As examiners beat Facebook officials on the call about the organization’s normal crumbling in its money related outcomes, its stock kept on sinking. Towards the finish of the call, a Jeffries examiner appeared to be shocked at the size of the development log jam, saying it “appears the extent is past anything we’ve seen.”

Wehner cautioned investigators not to expect the organization’s money related outcomes to show signs of improvement at any point in the near future.

The organization will probably be posting inferior working edges for

“quite a while … more than two, not as much as many,”

he said.

It’s an amazing drop-off for Facebook, and contradicts Wall Street’s desires. Prior in the day, its stock had hit another unsurpassed high of more than $218 an offer. A couple of short hours after the fact, that as of now appears like ancient history.

Original article by Rob Price