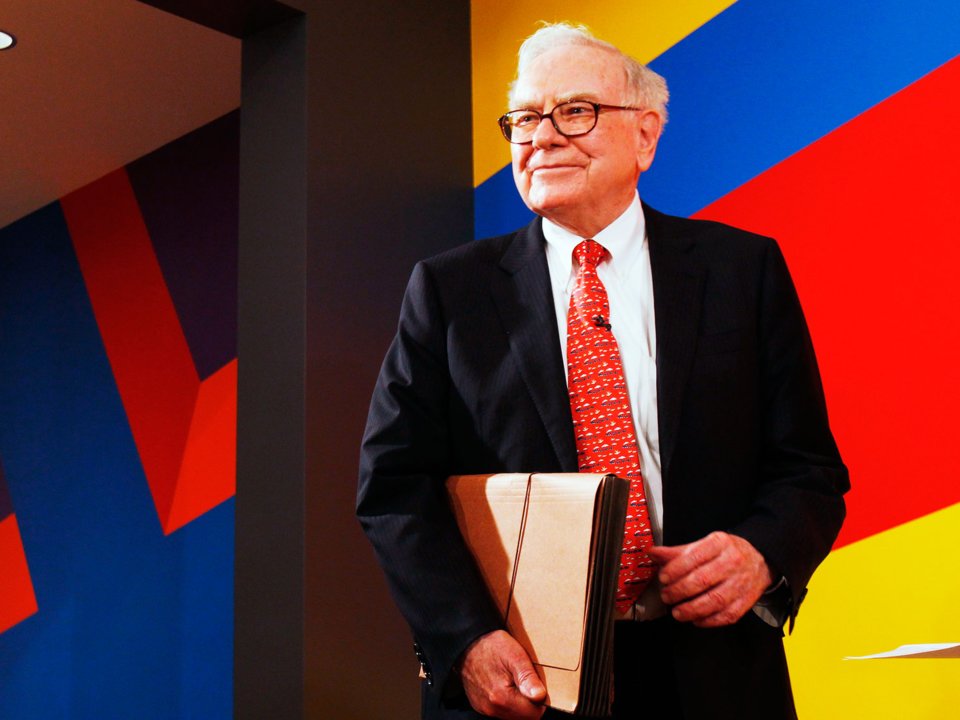

- With regards to getting rich, Warren Buffett is in a class all his own.

- The 87-year-old author and CEO of Berkshire Hathaway is worth $87 billion. He initially turned into a mogul when he was 32.

- Buffett’s aptitude and accomplishment with the share trading system has received real rewards and earned him a moniker: “The Oracle of Omaha.”

Best advice from Warren Buffett

Obviously, numerous individuals need to be as rich as Buffett. Truth be told, the vast majority would presumably make due with a small amount of his total assets. Gratefully he’s doled out some supportive exhortation throughout the years so others can take after his procedures.

Buffett and Berkshire Hathaway outstandingly put resources into stocks over securities and lean toward long haul methodologies to consistent day exchanging, yet it is more than what and how Buffett contributes that has made him fruitful.

Continue perusing for nine of Buffett’s best suggestions on getting rich.

Play the long game.

To profit, a speculator shouldn’t purchase a stock with the sole expectation of offering, Buffett accepts. You’re in it for the long amusement.

“Our favorite holding period is forever,”

Buffett first said in the 1988 shareholders’ letter.

Buffett just purchases supplies of organizations he comprehends and likes, and figures offering ought to be done when you require the cash and not when you trust it is a vital bouncing off point.

Always learn new things and be humble.

Quite a while back, Buffett gave a business person some exhortation over beverages. He advised her to master something consistently, go up against circumstances, and dependably be modest. Despite the fact that it’s not through and through contributing exhortation, it’s a methodology anybody in business would be savvy to mirror.

Buffett still experiences the daily paper each morning and peruses books for the duration of the day.

“That’s how knowledge works. It builds up, like compound interest,”

he says.

Invest your own money.

Indicating the four times that the estimation of Berkshire Hathaway plunged, Buffett clarified the inconvenience of utilizing advances to put resources into stocks in his 2018 yearly letter. A drop in the estimation of a stock may cause a speculator unneeded stress and prompt poor choices if the cash isn’t totally theirs in the first place, he said.

On the other side, Buffett said speculators with additional money and no obligation have extraordinary open doors when the market drops since they don’t need to stress over paying somebody back and can be forceful with their ventures.

Build relationships and treat people well.

At the point when Buffett went by Iowa State MBA understudies he conversed with them about progress. The audience members were astounded by how individual his recommendation was and how Buffett avoided specialized talk.

Look to the future, not the past.

“Of course the investor of today does not profit from yesterday’s growth,”

Buffett wrote in 1951. His words are still true decades later.

Buffett’s notice to financial specialists to search for future development and not be deceived by unsustainable past execution is useful while picking ventures.

Don’t assume a higher cost equals superior service.

Buffett has dependably championed inactive contributing over dynamic contributing.

In his 2017 investors’ letter, Buffett cautioned that occasionally rich individuals squander cash by contributing with high-cost speculation specialists.

“In numerous parts of life, in reality, riches commands top-review items or administrations,” he composed. “Thus, the budgetary ‘elites’ … have extraordinary inconvenience submissively agreeing to accept a money related item or administration that is accessible also to individuals contributing just a couple of thousand dollars.”

“Both vast and little financial specialists should stay with minimal effort list reserves,” he wrote in a 2016 letter.

Avoid herd mentality.

In 2004, Buffet said,

“try to be fearful when others are greedy and greedy only when others are fearful.”

As it were: purchase low, offer high. This counsel from Buffett cautions of the peril of following the group and offering approach to crowd mindset.

Buffett’s long-term system is to offer stock when the esteem is high, instead of scrambling to offer when its low and everybody is dreadful that it won’t come back to its high esteem.

Know when to cut your losses.

Knowing when to stop is a vital characteristic Buffett learned as a youngster endeavoring to recover his misfortunes at a stallion track. Subsequent to losing once, a youthful Buffett attempted to turn out even by wagering once more, just to lose twice as much as his underlying speculation.

Now and then, attempting to escape an opening will just get you into a more profound gap and Buffett recommends that you ought to regularly consider slicing your loses to avert additionally inconvenience.

Don’t focus too much on the money.

Buffett doesn’t need individuals to concentrate excessively on how much cash they have. Being rich is pleasant, however how you arrive and the general population who help and bolster you en route is the thing that issues the most.

“I tell college students, when you get to be my age you will be successful if the people who you hope to have love you, do love you,”

he said.

Original article by Matthew Michaels